glenwood springs colorado sales tax rate

With local taxes the total sales tax rate is between 2900 and 11200. Select the Colorado city from the list of popular cities below to see its current sales tax rate.

Types Of Taxes Types Of Taxes Indirect Tax Income Tax

This is the total of state county and city sales tax rates.

. The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales. 6 rows The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state. Learn about sales tax rates sales tax returns and more.

13 rows Sales Tax Rates in the City of Glenwood Springs. City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. For tax rates in other cities see Colorado sales taxes by city and county.

Colorado has recent rate changes Fri Jan 01 2021. Future job growth over the next ten years is predicted to be 405 which is higher than the US. Local tax rates in colorado range from 0 to 83 making the sales tax range in colorado 29 to 112.

100 US Average. One of a suite of free online calculators provided by the team at iCalculator. It also contains contact information for all self-collected jurisdictions.

Sales Tax on Food. This document lists the sales and use tax rates for all Colorado cities counties and special districts. The Glenwood Springs sales tax rate is 37.

Order the Official Travel Guide today for a complete activity lodging dining directory and vacation inspiration. The County sales tax rate is 1. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The combined amount is 820 broken out as follows. Real property tax on median home.

The Colorado Springs sales tax rate is. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is 86. If your business is located in a self-collected jurisdiction you must apply for a.

This is the total of state county and city sales tax rates. Click here for a larger sales tax map or here for a sales tax table. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities.

If you need assistance see the FAQ. Glenwood Springs Colorado and Broomfield Colorado. The County sales tax rate is.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. To begin please register or login below. The Colorado sales tax rate is currently 29.

The colorado sales tax rate is 29 the. What is the sales tax rate in Glenwood Springs Colorado. Current City Sales Use Tax Rate.

This is the total of state county and city sales tax rates. Where world-famous hot springs meet year-round outdoor adventures. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Glenwood Springs Colorado.

Sales tax rate in Glenwood Springs Colorado is 8600. 307 City of Colorado Springs self-collected 200 General Fund. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57.

Citizens service center 1675 w. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. You can find more tax rates and allowances for Glenwood Springs and Colorado in.

The state sales tax rate in Colorado is 2900. The Glenwood Springs sales tax rate is. Sales Tax Online Services.

Glenwood Springs limits 001 000 RTA Regional Transportation Authority Roaring Fork Aspen and Snowmass Village city limits unincorporated Pitkin County 000 000 RTA Regional Transportation Roaring Fork Areas of unincorporated 001 000 Page 11 of 22 04152022 Use Tax Rates for Districts in Colorado. The Colorado sales tax rate is currently. MUNIRevs allows you to manage your municipal taxes licensing 24x7.

Below 100 means cheaper than the US average. 4 rows Glenwood Springs CO Sales Tax Rate The current total local sales tax rate in Glenwood.

Colorado Sales Tax Rates By City

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

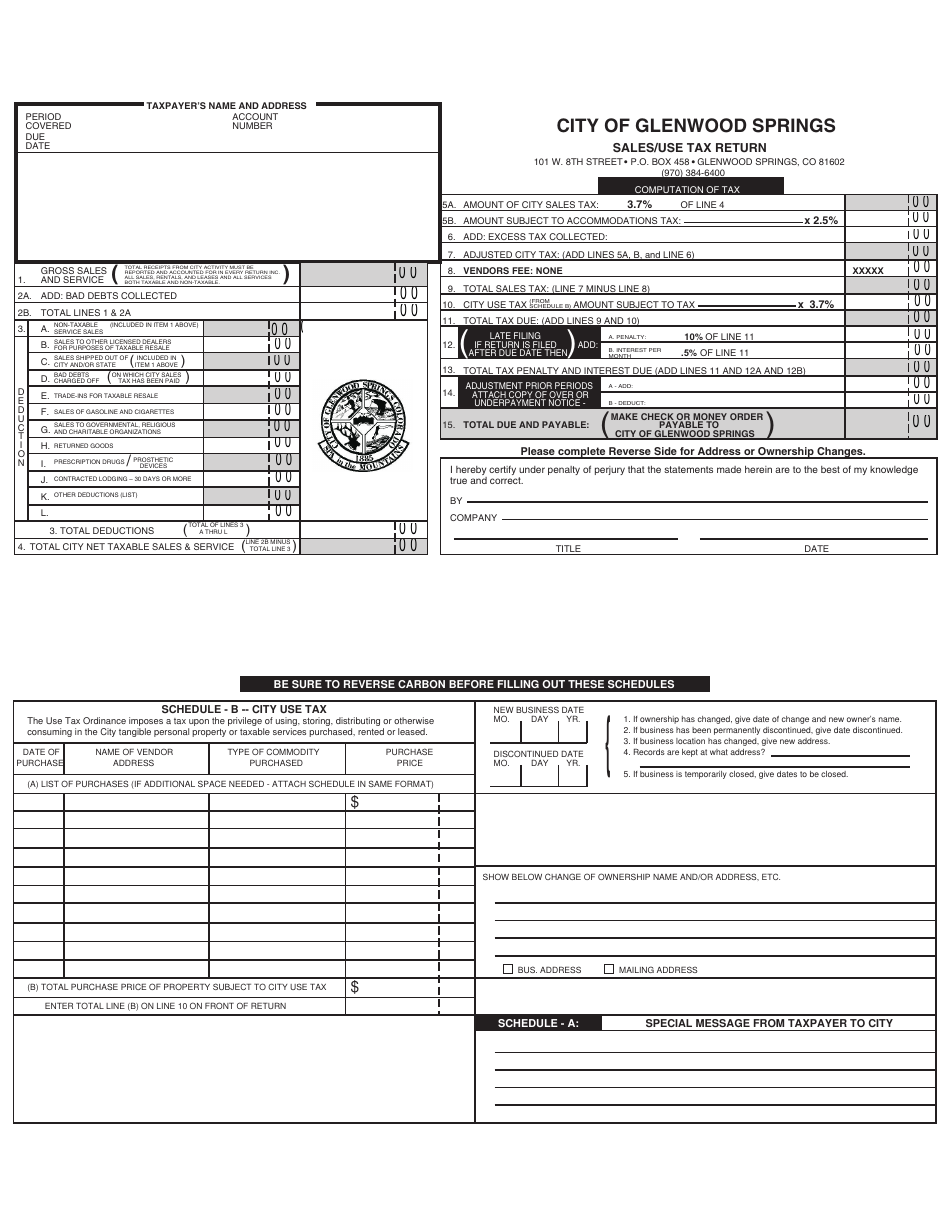

City Of Glenwood Springs Sales Use Tax Return Form Download Printable Pdf Templateroller

Georgia Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Glenwood Springs Economy Is Strong As City Reports Sales Tax Collection Exceeded 2021 Forecast Aspentimes Com

Alabama Sales Tax Rates By City County 2022

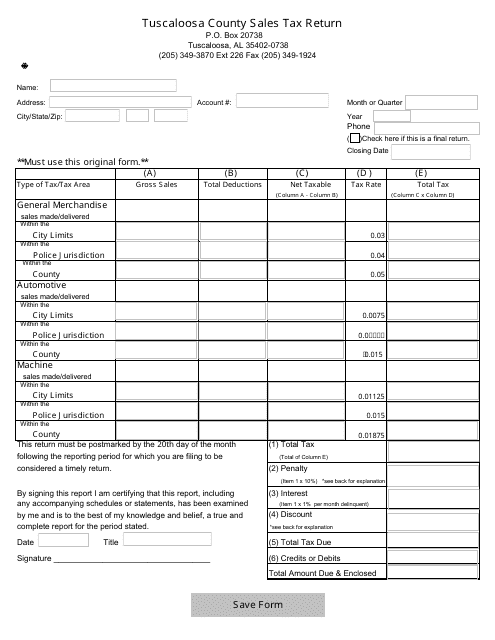

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Marijuana Sales Tax Department Of Revenue Taxation

Florida Sales Tax Rates By City County 2022

New Mexico Sales Tax Rates By City County 2022

2021 Sales Tax Reports Show Spending In Summit County Has Returned To Pre Pandemic Levels Summitdaily Com

Utah Sales Tax Rates By City County 2022

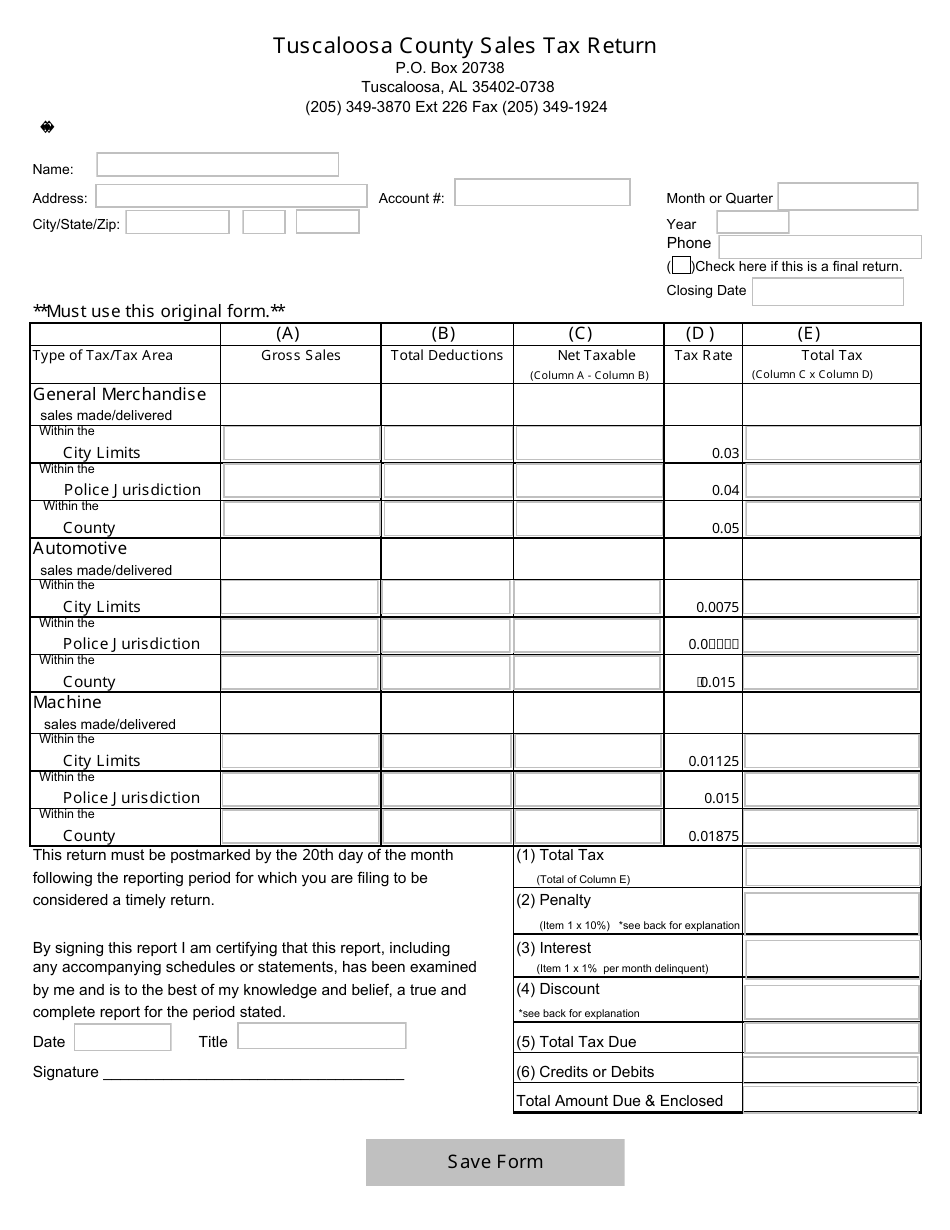

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Washington Sales Tax Rates By City County 2022